School district budget requires no new taxes

FLEMING ISLAND – The Clay County School District is one step closer to approving its budget for the 2017-18 budget cycle having met July 20 to approve tentative millage rates for local …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continueDon't have an ID?Print subscribersIf you're a print subscriber, but do not yet have an online account, click here to create one. Non-subscribersClick here to see your options for subscribing. Single day passYou also have the option of purchasing 24 hours of access, for $1.00. Click here to purchase a single day pass. |

School district budget requires no new taxes

FLEMING ISLAND – The Clay County School District is one step closer to approving its budget for the 2017-18 budget cycle having met July 20 to approve tentative millage rates for local funding.

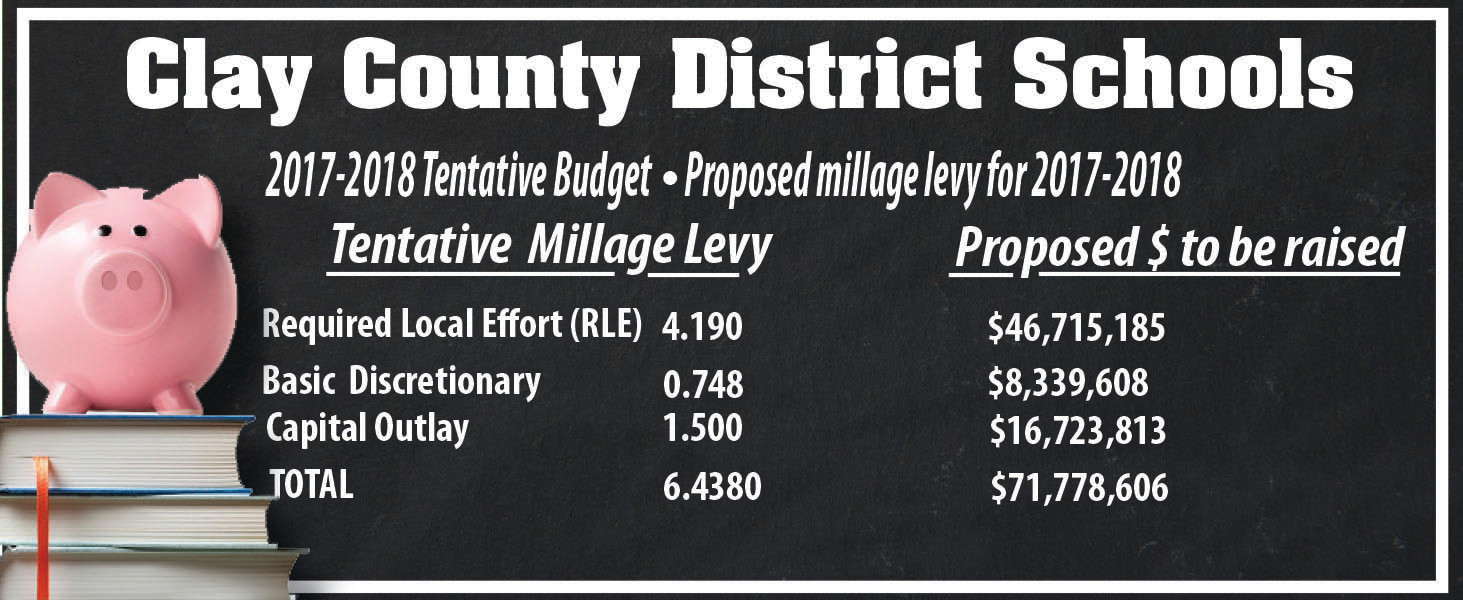

“Our millage rate pretty much went down,” said Susan Legutko, assistant superintendent of business affairs. “What that means is in the prior year, our total rate was 6.762. The Required Local Effort was 4.514 the prior year – the current year it’s 4.190, there is a reduction there.”

The proposed, tentative total millage rate for 2017-18, Legutko said, will be 6.438. Overall, the district’s required local effort – revenue that must be generated on the local level in order to receive state funding – will drop $589,466 for a total of $46,715,185, down from the 2016-17 level of $47,304,651. The same 6.438 mills will generate $16,723,813 for capital outlay projects for the coming year.

Legutko said, at the same time the calculation for the required local effort dropped, the state funding program known as Florida Education Finance Program or FEFP, only went up $32 per pupil.

“Even though they said we earned $100 more, that’s not a true statement,” Legutko said.

Legutko said the district’s budget will not require a tax increase for 2017-18. Residents have an opportunity to provide input on the district budget on Aug. 1 at the first of two state-mandated public hearings.

In presenting the budget, Legutko was explained something called the Rolled-Back Rate, a legislatively-created calculation that places the onus of taxation on the school district and not the legislature.

“…the Rolled-Back Rate is the new millage rate that it would take to produce the same amount of property tax revenue using the new-year property tax roll, as was produced the year before by the prior-year actual millage rate and the prior-year tax roll,” states documents from her July 20 presentation to the board at the Fleming Island High Teacher Training Center.

In early July, Clay County Property Appraiser Roger Suggs stated that property values have increased in Clay County by more than $636 million for a total value of $9.9 billion.

The district’s overall budget is projected at present to be $386,389,412, with its general fund taking up the brunt of that amount at $297,072,373.

In her presentation, Legutko also updated board members on the health of the district’s reserved fund balance, which acts as a sort of safety net in the event of a sharp downturn in revenues. At present, she said the fund balance is at 4.27 percent – $11.4 million – and by June 30, 2018, it is projected to be 4.51 percent, or $12.2 million.

In previous years, when the fund balance dipped to as low as 2.12 percent on June 30, 2013, it caught the attention of such Wall Street firms as Moody’s, which grades businesses and governments on their financial health.

In late August 2014, Moody’s downgraded the district’s issuer long term rating one step from Aa3 to A1. In the most recent call with Moody’s Legutko said the rating was kept status quo with no upgrades or downgrades enacted.

In a related item the board took up in its July 25 agenda workshop, the board discussed another matter that will improve the district’s financial health – refinancing what are called Certificates of Participation, which are financial instruments much like bonds that were purchased to fund new school construction in the past 20 years. The board will discuss the COPs at its Aug. 3 meeting.