Clay County has an important financial decision to make

jack@claytodayonline.com

GREEN COVE SPRINGS – During the Board of County Commissioners meeting on March 12, the dais discussed the potential benefits of assuming $64.5 million dollars in debt to ensure construction …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, or purchase a new subscription.

If you are a current print subscriber, you can set up a free website account and connect your subscription to it by clicking here.

If you are a digital subscriber with an active, online-only subscription then you already have an account here. Just reset your password if you've not yet logged in to your account on this new site.

Otherwise, click here to view your options for subscribing.

Please log in to continueDon't have an ID?Print subscribersIf you're a print subscriber, but do not yet have an online account, click here to create one. Non-subscribersClick here to see your options for subscribing. Single day passYou also have the option of purchasing 24 hours of access, for $1.00. Click here to purchase a single day pass. |

Clay County has an important financial decision to make

GREEN COVE SPRINGS –During the Board of County Commissioners meeting on March 12, the dais discussed the potential benefits of assuming $64.5 million dollars in debt to ensure construction priorities are completed and completed quickly.

Clay County finds itself in an age of relatively high interest (5.5%) and inflation (3.4%) rates. The county is also an unprecedented era of growth.

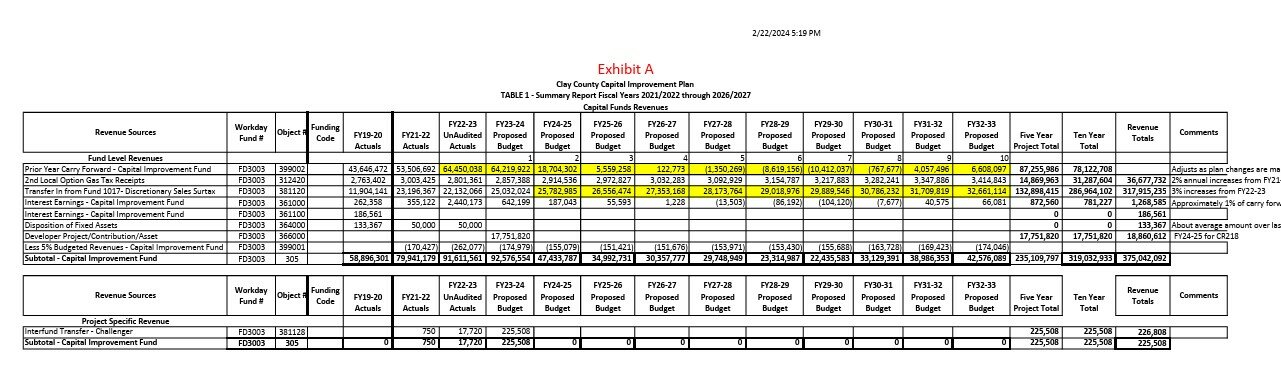

This presents a unique financial challenge to the Board of County Commissioners, especially for many line-item priorities in the Capital Improvement Plan, funded through impact fees, sales and gas taxes.

The good news:

The county has realized significant sales tax revenue growth, double since 2012.

According to Clerk of Court and Comptroller Tara Green, the county is financially in a “really good position.”

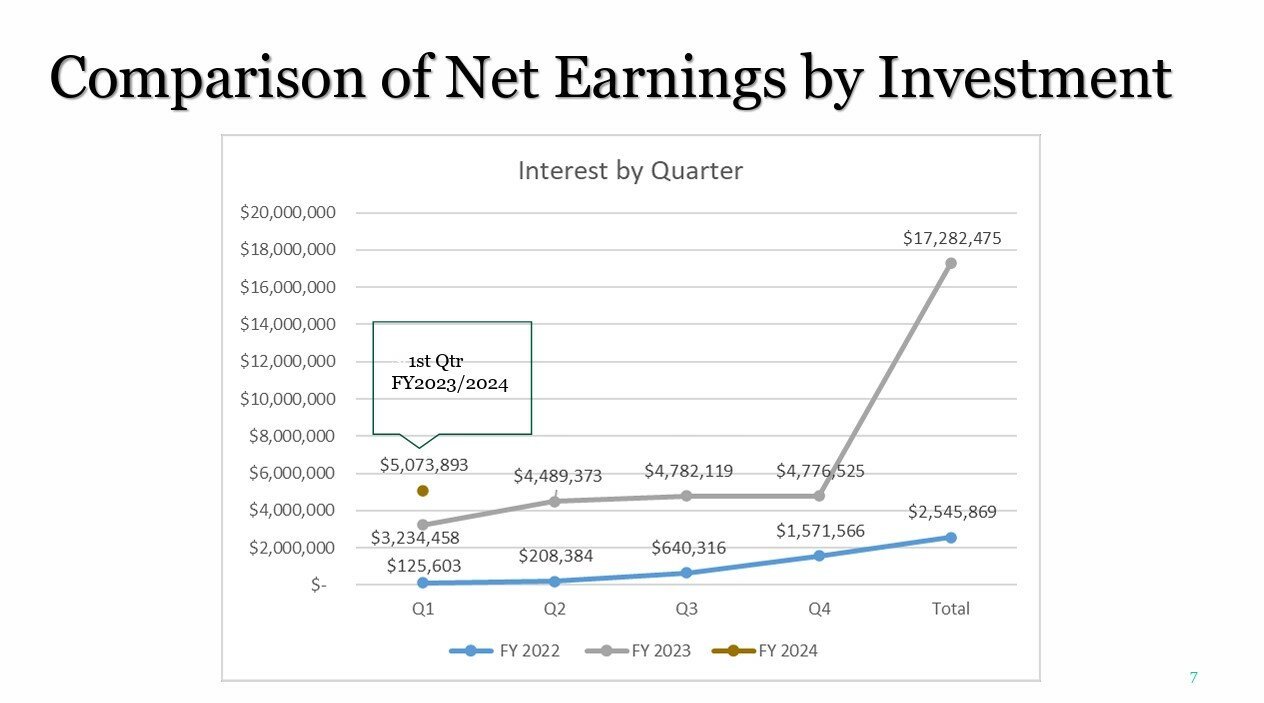

During the BCC meeting on March 12, Green presented an investment update. The county has $492 million in investments and earned $5 million in interest for the first quarter of this fiscal year, a silver lining from the historically high interest rates.

The less-than-good news:

Indeed, interest rates are relatively high. The inflation rate is, too, especially regarding the raw materials involved in construction.

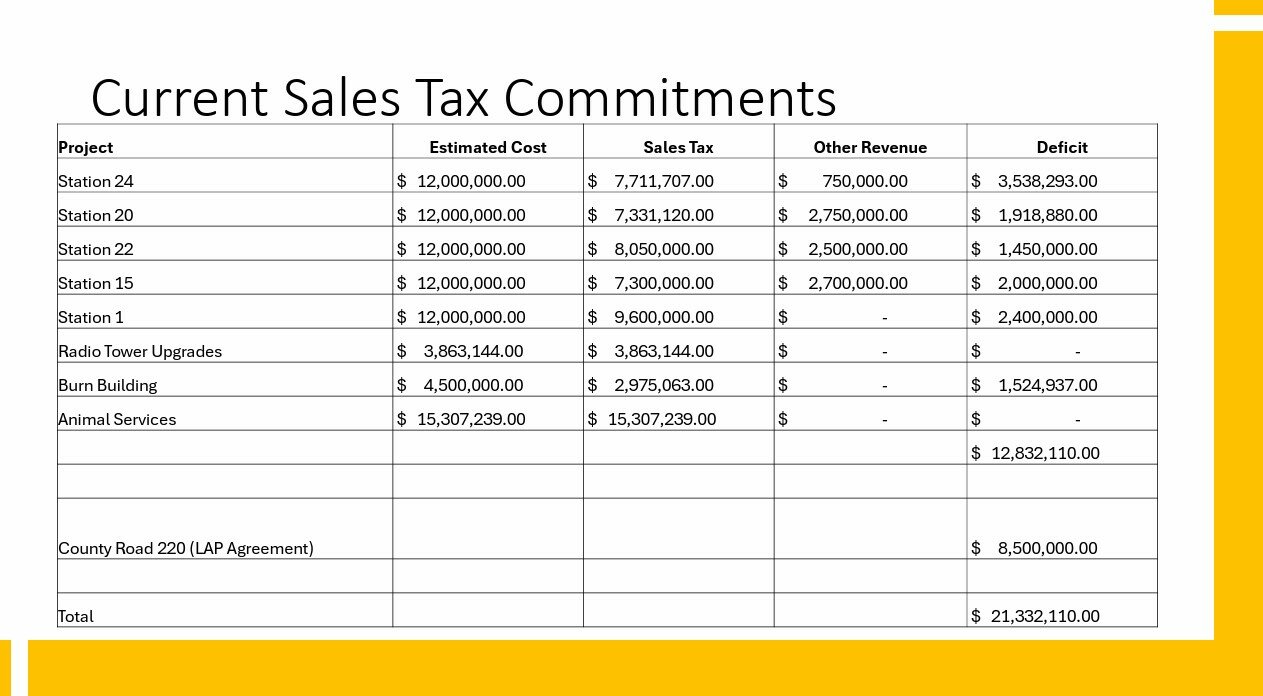

Items in the CIP were budgeted with pre-inflation costs. There is a deficit of sales tax revenue which was committed (revenue for the CIP) and what the price tag for the construction projects would actually be, following inflation.

Over the next five years, the deficit would be $21.3 million to complete five fire stations, a burn building, improvements to County Road 220 and more.

The challenge:

Borrowing money has a monetary cost, and inflationary pressure is making construction more expensive. The BCC will have to weigh both sides of that scale.

The BCC has expressed interest in completing these projects, County Road 220 in particular. By offering $8.5 million for a LAP (Local Agency Program) agreement, the county would qualify for a $12 million grant from the Florida Department of Transportation, which would be used on CR 220.

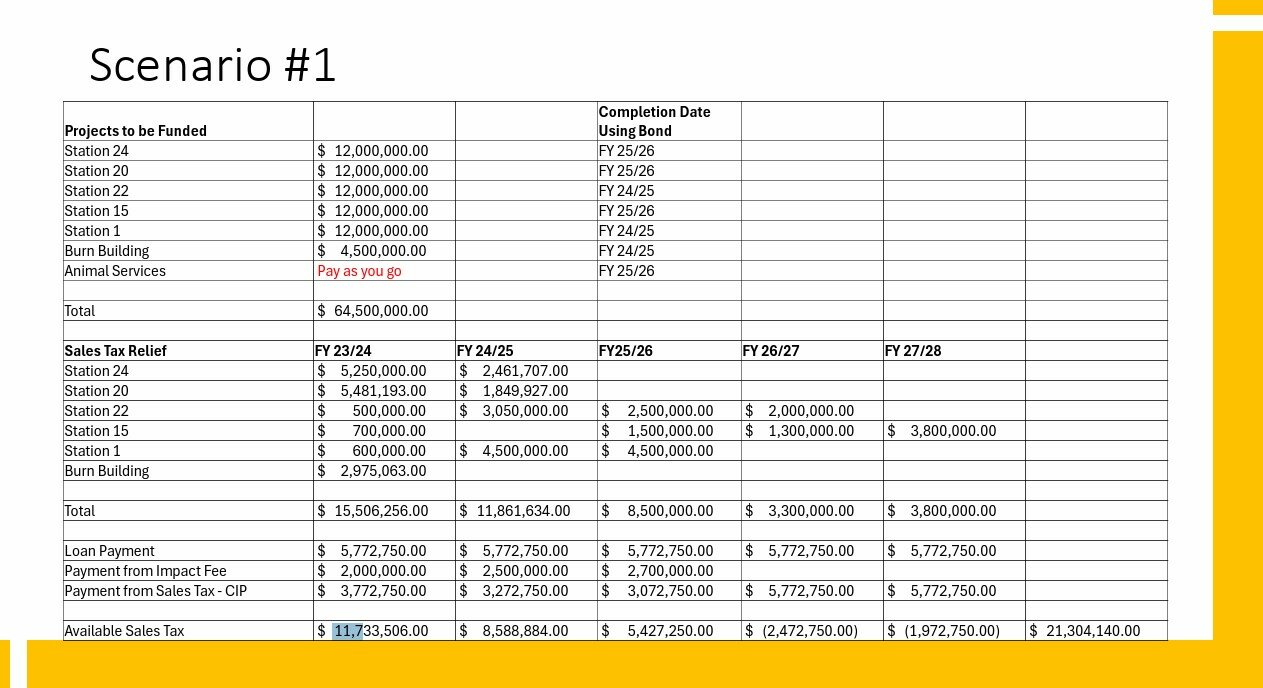

One proposal that garnered interest was Scenario No. 1. The county would assume $64.5 million in debt to free up $11.7 million for this fiscal year.

"It's not really $11.7 million; it's really only $3 million," Commissioner Alexandra Compere said, referencing the BCC's expressed interest to commit $8.5 million for CR 220.

Compere said with the $8.5 million commitment taken into consideration, the figures were less attractive.

Alternatively, Commissioner Betsy Condon appeared receptive to the municipal financing proposal.

"We have a list of eight fire stations that are county is in desperate need of. These fire stations (would be) able to (completed) by the end of fiscal year 2026," Condon said.

"It's imperative to me to provide public safety access to our residents," she said. "Your homeowners insurance rates will go down if we can put these fire stations close to you."

Commissioner Mike Cella also appeared receptive. He said he liked Scenario No. 1 because it would promote public safety and free up funds so that the BCC could make the $8.5 million contribution to CR 220.

Assistant County Manager Troy Nagle said the county receives about $25 million in CIP revenue annually. This is in addition to $64 million that has carried over from last year. He said the county has already spent $74 million for capital projects.

PFM, a financial consulting group for Clay County, said taking on debt would be within the county’s means.

"Interest earning on project funds are currently higher than the borrowing rates, so the result is a very efficient funding plan to recover earning while mitigating future inflation risk,” PFM said.

There was no vote regarding the municipal financing proposal. The ongoing discussion will continue next BCC meeting on Tuesday, March 26.