District’s tentative budget gets go-ahead

FLEMING ISLAND – Every governmental agency in the county has a budget that’s malleable for a fiscal year generally overseeing every dollar earned, spent and saved.

The Clay County School …

This item is available in full to subscribers.

Attention subscribers

To continue reading, you will need to either log in to your subscriber account, below, or purchase a new subscription.

Please log in to continueDon't have an ID?Print subscribersIf you're a print subscriber, but do not yet have an online account, click here to create one. Non-subscribersClick here to see your options for subscribing. Single day passYou also have the option of purchasing 24 hours of access, for $1.00. Click here to purchase a single day pass. |

District’s tentative budget gets go-ahead

FLEMING ISLAND – Every governmental agency in the county has a budget that’s malleable for a fiscal year generally overseeing every dollar earned, spent and saved.

The Clay County School District board unanimously voted last week to set a tentative budget for the 2022-23 fiscal year at a public hearing last week.

District Assistant Superintendent for Business Affairs Susan Legutko broke down levying the 6.419 millage rate, which consisted of the required local effort (3.171 mills), the basic discretionary millage (0.748 mills), and additional voted millage (1 mill) and for capital outlay (1.5 mills).

She said property values skyrocketed and raised challenges for taxing agencies.

“This is not just for Clay County,” Legutko said. “This is for the state of Florida.”

She drew attention to the district's 1 mill levy, which has been in effect for four years. It will go before voters in the general election three months from now. The 1 mill is expected to generate $16.5 million, which the district said is for school security purposes whether hardening buildings or funding for the police department.

“Those are the funds we’re expecting to collect this tax year,” Legutko ssaid.

Overall, district figures said $106,269,536 would be generated from the levies. The state makes up a large portion of the general fund, about 70% of revenues, or about $250 million.

As for the total budget, it calls for a $385 million general fund. Roughly 78.75% of the general fund is slated for salaries and benefits. Later in the meeting, board members did see how the new self-insurance policy for district employees would work.

“It will be effective Oct. 1. There’s still some setting up we need to do on that,” she said.

The total tentative budget for 2022-23 fiscal year including the general fund is $593,489,578, according to the district. There’s almost $119 million for capital projects and $81 million in special revenue. About $7 million is devoted to debt service.

She said the budget changes regularly due to adjustments.

“A lot of this is just an estimate at this time,” Legutko said.

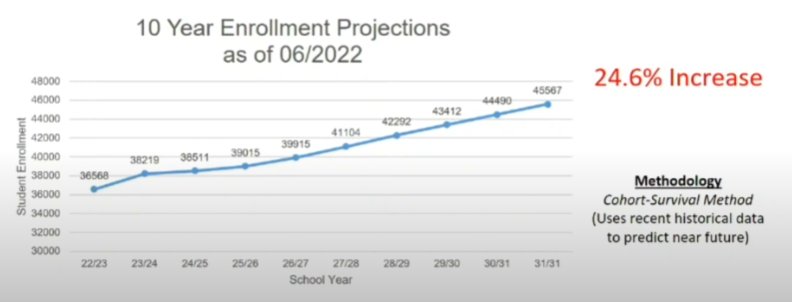

The district’s planner, Lance Addison, shared projection data concerning the district’s future. On the high end, the county could have 352,000 residents by 2050.

“From what we have now to (2050), that’s a 61.5% increase on the high projections,” Addison said. "… That tells you we are growing rapidly.”

The district has plans for building at least six schools within 10 years. The organization has to keep up with adding a projected 9,000 students, according to the Florida Department of Education’s Capital Outlay Full Time Equivalency data.

“Every year in June, the COFTE projections change. They come out with a new projection,” Addison said.

School board members set Sept. 8 for a public hearing on the budget.